In today’s fast-paced business environment, efficient payment running is essential intended for success. If you are the seasoned entrepreneur or just starting out, knowing the role involving a payment running agent can give you with the various tools necessary to thrive. These professionals do more than just facilitate transactions; they function as valuable partners in navigating the intricate landscape of vendor services, ensuring you could offer your buyers seamless payment choices while maximizing your profits.

As businesses regarding all sizes progressively rely on electronic digital transactions, the significance of possessing a committed payment processing broker cannot be over-stated. From reducing scam and enhancing customer experience to protecting the best repayment processing rates, the benefits of working with an expert in this field usually are immense. This post will discover why partnering along with a payment control agent is essential for the business expansion and outline the essential features you should look for on a trusted repayment processing solution.

The Imperative Role of Transaction Processing Agents

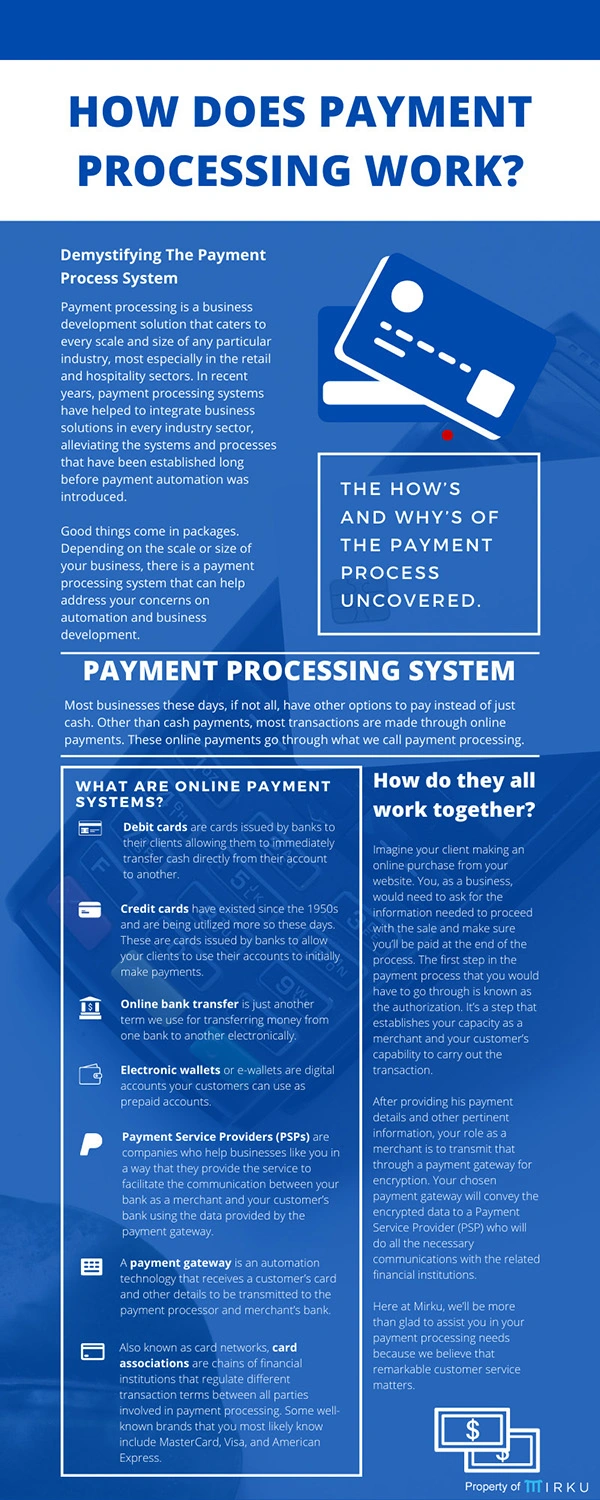

Payment processing agents play some sort of crucial role in facilitating smooth purchases between businesses in addition to their customers. They will act as intermediaries, simplifying the complexness of payment systems and ensuring that merchants can accept various types of transaction without hassle. This specific ensures an unlined purchasing experience intended for consumers while letting businesses to pay attention to their particular core operations. By simply offering tailored options that fit the actual needs of each and every business, payment running agents can improve client satisfaction and dedication.

Throughout addition to efficiency payment acceptance, these types of agents provide valuable insights into purchase data, helping businesses make informed choices. They can identify trends and patterns in customer behaviour, allowing merchants to be able to optimize their techniques and improve revenue. By staying informed of the latest payment processing trends and technologies, agents can certainly advise businesses about the most successful options, including mobile payments and web commerce solutions. Their experience can significantly impact a business's ability to thrive inside a competitive gardening.

Moreover, payment processing providers are essential inside ensuring security and even compliance within typically the payment ecosystem. That they help businesses get around the complexities involving PCI compliance plus implement measures to be able to reduce fraud, guarding both the business as well as customers. By prioritizing secure purchases and transparent costs, payment processing brokers enable businesses to be able to build trust in addition to enhance their reputation in the market. This support enables companies to not just reduce risks but also to target on growth in addition to expansion.

Benefits of Partnering with a Repayment Processing Agent

Partnering using a payment digesting agent offers companies a streamlined method to handle purchases effectively. These providers specialize in knowing the complexities of payment systems, allowing businesses to focus on their very own core activities. Simply by leveraging is The Card Association legit of a payment processing agent, companies can ensure that their payment businesses run smoothly, lessening disruptions and improving customer satisfaction.

Another substantial benefit is typically the entry to better repayment processing rates plus terms. Payment processing agents have set up relationships with various service provider account providers, giving them the ability to negotiate favorable prices for their consumers. This can business lead to substantial personal savings, especially for smaller businesses that might find it challenging to be able to secure competitive costs on their possess. Cost efficiency can directly impact some sort of company's bottom line, making it an interesting reason to participate with a transaction processing agent.

Lastly, repayment processing agents stay up-to-date with sector trends and polices, including security standards like PCI conformity. This knowledge assists businesses mitigate disadvantages associated with fraudulent activities and remain compliant with lawful requirements. By partnering with an broker, businesses can enhance their security measures, guard sensitive customer information, and build rely on with the clientele, in the end leading to long-term good results.

Developments and Future associated with Payment Control

Once we glimpse ahead to the future of transaction processing, one associated with the most significant trends is typically the increasing adoption involving mobile payments. Buyers are embracing the convenience of having to pay through their cell phones, which is prompting businesses to take up mobile-friendly payment solutions. find out here now enhances buyer experience but also demands that transaction processing agents remain informed about the latest mobile repayment technologies and systems to effectively guidebook their clients.

Another distinctive trend will be the developing focus on safety and compliance. With all the surge in online transactions, the risk of fraud offers also escalated, rendering it essential for businesses to implement robust security measures. Repayment processing agents carry out an important role inside helping businesses find their way the complexities associated with PCI compliance and implementing tools to mitigate fraud dangers. Staying updated in the latest protection technologies and polices will be essential for agents in order to support their consumers effectively.

Lastly, the integration associated with artificial intelligence plus data analytics in payment processing will be set to change the. These technologies can optimize transaction processes, analyze customer behavior, and enhance personalization in obligations. Payment processing brokers must familiarize them selves with one of these advancements in order to offer their clientele innovative solutions of which can improve performance and drive income growth. Understanding precisely how to leverage AI and analytics will certainly be key intended for agents looking to stay competitive inside the evolving scenery of payment running.